开云足球彩票规则查询

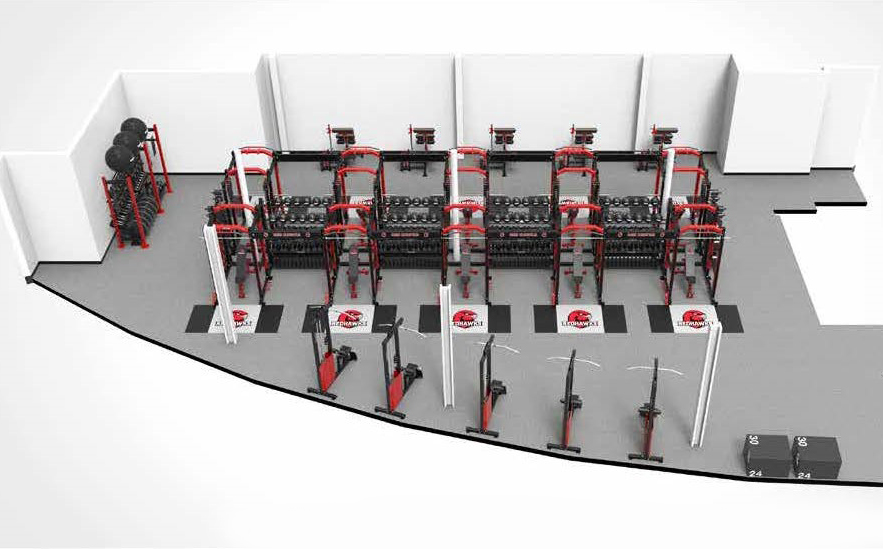

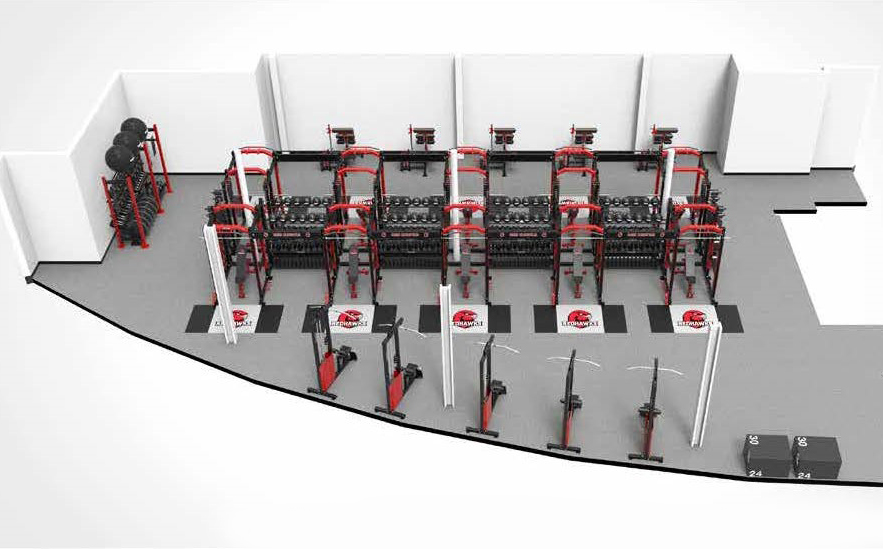

不管它是帮助客户确定他们的设备需求,或者设计一个全面的健身空间,满足用户的需求,太平洋健身产品几十年的经验在业界创造最佳的健身环境。开云平台官网入口网页版登录我们使用地板计划和3 d渲染来帮助我们的客户最好的解决方案,并推荐该空间的理想设备。

开云足球app下载官网最新版本

需要服务在你的设备吗?

填写一份申请表今天开始服务。

不管它是帮助客户确定他们的设备需求,或者设计一个全面的健身空间,满足用户的需求,太平洋健身产品几十年的经验在业界创造最佳的健身环境。开云平台官网入口网页版登录我们使用地板计划和3 d渲染来帮助我们的客户最好的解决方案,并推荐该空间的理想设备。

填写一份申请表今天开始服务。